Stock expected move calculator

And this quick tutorial will show y. Just follow the 5 easy steps below.

How To Calculate Beta With Pictures Wikihow

Taking the at the money front month straddle.

. You can call it your option strategy calculator. Our Suite of Platforms isnt Just Made For the Trading Obsessed - its Made by Them. Ad Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator.

Search to see expected moves. The expected move is the amount that options traders believe a stock price will move up or down. Using the above figures one can now calculate the markets expected move for AAPL through the January 2022 monthly options expiration which occurs on Jan.

JAN options expire in 22 days that would indicate that standard deviation is. Now the cost of the ATM straddle is Cost of 9650CE Cost of 9650PE 10615 76. Add the price of the front month ATM call and.

A python script to generate stock expected move. What is the Expected Move. The Stock Calculator is very simple to use.

As well as a variety of free analysis and education tools to the public. Find the observation at the 25th percentile and the 75th percentile. 1 At The Money Straddle.

The current Implied Volatility is 316. Expected move gives traders the chance to calculate an expected range of price movement for a stock in a certain timeframe. The expected move of a stock for a binary event can be found by calculating 85 of the value of the front month at the money ATM straddle.

The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line. A python script to generate stock expected move with implied volatility - GitHub - lianwangtaoExpectedMoveCalculator. Subtract the 25th from the 75th.

All that means is looking at the last traded price picking the nearest strike and buying the call and the put both. Take that difference and divide by two. Assuming 252 trading days per year which has been the average for US stock and option markets in the last years you can convert annual implied volatility to daily volatility by dividing it by the.

A one standard deviation range encompasses 68 of the expected outcomes so a stocks expected move is the magnitude of that stocks future price movements with 68. Options AI provides an advanced options trading platform for its registered users. Discover the Power of thinkorswim Today.

I have read that there is an Expected Move Formula to calculate one standard deviation stock price range for any time period. First will be the pricing of the at the money straddle. Enter the purchase price per share the selling price per share.

It can serve as a quick way to see where real. A stocks expected move represents the one standard deviation expected. For Example Current Nifty Spot Price is 967480 so the ATM strike price is 9650.

Expected Move Stock Price x Implied Volatility 100 x square root of Days to Expiration 365 When using this formula pay careful attention to which implied volatility value. 32362 x 316 x SQRT 22365 2511. Ad Manage volatility w a tool that directly tracks the vol market.

That will give you the semi. Enter the number of shares purchased. VIX options and futures.

Calculating the expected move is a great tool to use when determining how far OTM to sell options for an earnings set-up. A one standard deviation range encompasses 68 of the. As discussed in the Expected Move post the expected movement of a stock can be calculated with the following formula where S subscript 0 is the stocks current price IV is.

Stock Price x Implied Volatility x SquRoot.

Pin On Siddharth Shankar Kassa Inputs On Ecb External Commercial Borrowing

Volatility Formula Calculator Examples With Excel Template

3

How To Calculate The Expected Move Of A Stock Youtube

1

Market Capitalization Calculator

Stock Price Calculator For Common Stock Valuation

Stock Average Calculator Cost Basis

Stock Split Formula And Google Example Calculator Excel Template

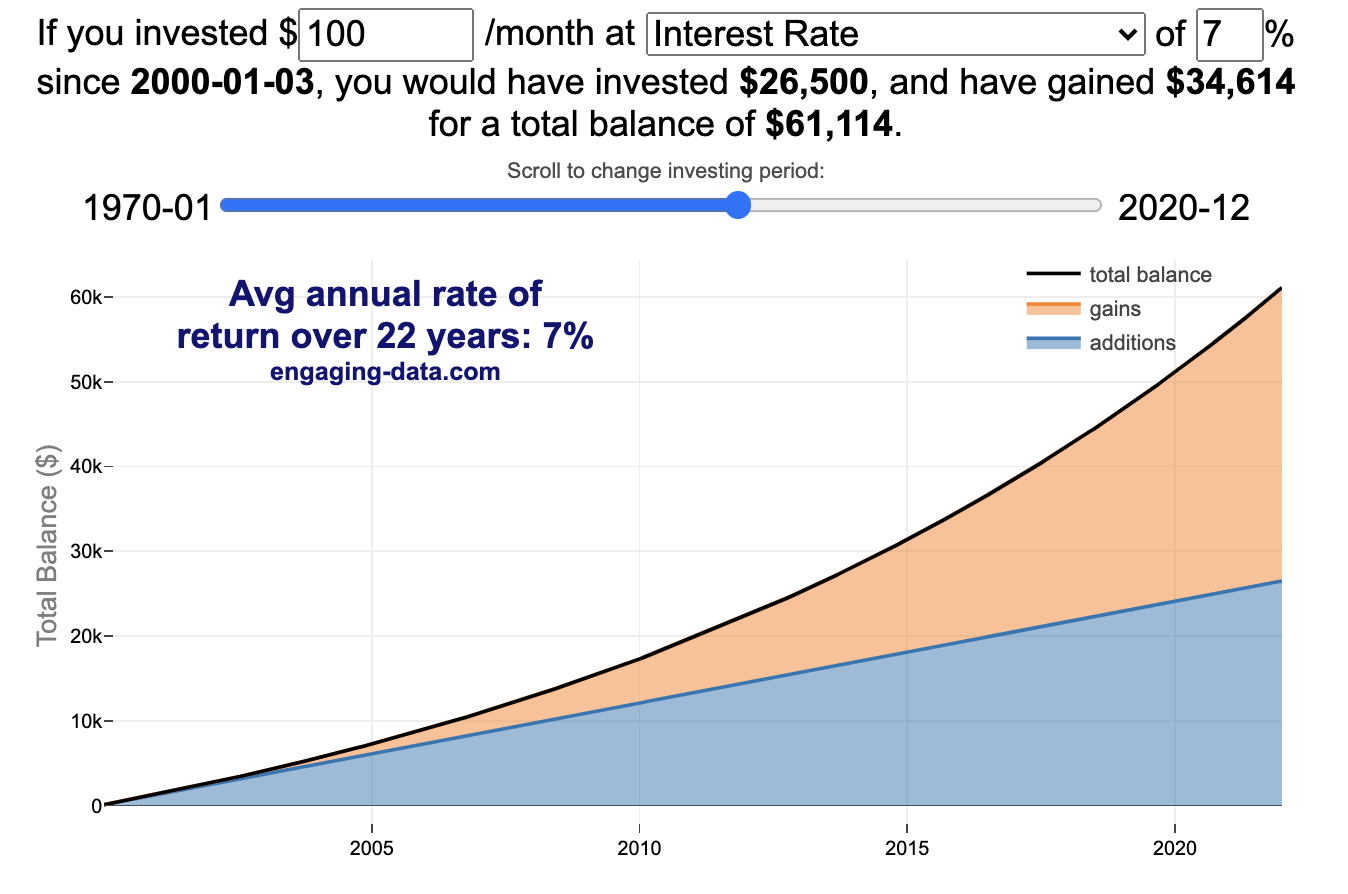

Compound Interest And Stock Returns Calculator Engaging Data

Expected

How To Calculate The Expected Move Of A Stock

Stock Calculator

3

On Todays Podcast We Talk About Fbs Earnings And How To Calculate The Expected Move Of Any Stock Over Any Time Frame List Podcasts Today Episode Earnings

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Options Profit Calculator Options Calculator